You have put an offer in on your dream home and it has been accepted! You are looking at finalizing your mortgage loan and want to understand the process as best as possible to make sure you are getting the best rates and saving as much money as possible. After all, you just bought a new home, and while you can afford it, it still may seem a little scary that you are responsible for the upkeep, maintenance, and repairs that come with owning a home.

You have put an offer in on your dream home and it has been accepted! You are looking at finalizing your mortgage loan and want to understand the process as best as possible to make sure you are getting the best rates and saving as much money as possible. After all, you just bought a new home, and while you can afford it, it still may seem a little scary that you are responsible for the upkeep, maintenance, and repairs that come with owning a home.

There are two types of mortgages that can affect how the interest rate is applied to your home loan.

Fixed-Rate – same interest rate for the life of the loan

Adjustable-Rate – a set interest rate for a certain time frame/period – after that the rate varies depending on market conditions

Interest rates can change daily and are affected by a number of contributing factors such as inflation, bond market conditions, economic factors, and economic growth & housing conditions. Because of this, it is strongly advised that you try to lock in a favorable interest rate to avoid the ups & downs of market fluctuations. That being said, the interest rate that you qualify for greatly depends on factors such as your financial situation, credit score, down payment capabilities, loan amount, and your debt to income ratio.

From there you also have to take into consideration your APR as well. Many often confuse interest rate & APR thinking that the two are one and the same. But when it comes to home mortgages they are not! Your APR or annual percentage rate takes ALL of the fees of your home loan into account. Such as your closing cost, lender fees, interest rate, etc. In general, your APR tends to provide a more complete overview of the total cost of your mortgage on an annual basis.

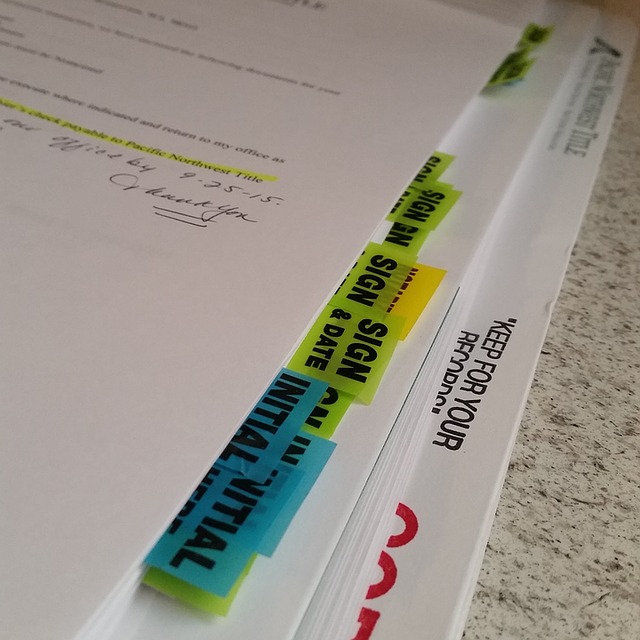

In the end, it is best to work with a trusted mortgage broker and real estate agent you can trust. He can help to ensure that not only does the entire home buying process go smoothly but that it is also as understandable, and financially sound as possible.